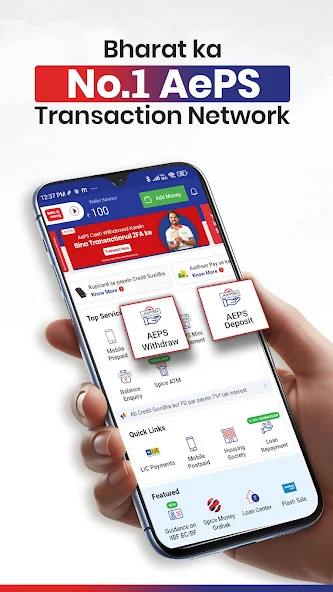

Setting up a Digital Grahak Seva Kendra is a practical business idea for individuals seeking to provide essential digital and financial services to underserved communities. This model bridges the gap between rural populations and financial inclusion through accessible services such as Aeps Service, bill payments, and account-related facilities.

If you are looking to understand how to start your own Digital Grahak Seva Kendra, this breaks down the complete process in simple and structured steps.

What is a Digital Grahak Seva Kendra?

A Digital Grahak Seva Kendra is a local service point where customers can access a range of digital and financial facilities without visiting a bank branch. These centers support individuals in rural and semi-urban areas by offering services such as cash withdrawal, balance inquiry, utility bill payments, mobile recharge, and more using digital platforms.

These centers often use Aeps Service (Aadhaar Enabled Payment System) to facilitate secure transactions using the customer’s Aadhaar number and biometric verification. It enhances access to essential banking services even in the most remote locations.

Benefits of Opening a Digital Grahak Seva Kendra

Opening a Digital Grahak Seva Kendra offers several advantages:

Low Initial Investment

The setup requires minimal infrastructure – a computer or laptop, internet connectivity, fingerprint scanner, and printer.

Steady Earning Potential

With a range of services available, the operator can earn commissions on every transaction, whether it’s a mobile recharge or an Aeps Service transaction.

Social Impact

By providing financial access in rural areas, operators contribute to digital literacy and economic inclusion.

Local Recognition

Being a service provider in your locality helps you build trust and a stable customer base.

Who Can Open a Digital Grahak Seva Kendra?

Starting this setup doesn’t require a specific background, but the following criteria are generally expected:

- Age 18 years or above

- Basic understanding of computers and digital transactions

- A valid identity proof and address proof

- A space to operate the center – either a shop or a room

This model is suitable for local entrepreneurs, unemployed youth, shopkeepers, and women seeking self-employment.

Required Documents for Setup

To open a Digital Grahak Seva Kendra, certain basic documents are required for registration and verification. These usually include:

- Identity proof (such as Aadhaar card or voter ID)

- Address proof (such as electricity bill or ration card)

- Recent passport-sized photographs

- Bank account details for payment settlement

- Email ID and mobile number for communication

If biometric transactions are involved, a fingerprint scanner device approved for Aeps Service will be needed as well.

Infrastructure and Equipment Needed

Setting up a fully operational Digital Grahak Seva Kendra requires basic yet essential infrastructure:

Computer or Laptop

Used to manage transactions and customer records.

Internet Connection

Stable internet ensures smooth processing of services.

Biometric Scanner

A fingerprint scanner is required to authenticate Aadhaar-based transactions via Aeps Service.

Printer

Used for printing receipts or service confirmations.

Basic Office Setup

A table, chair, and clean workspace for both operator and customers.

Step-by-Step Process to Start Your Digital Grahak Seva Kendra

Here’s a simplified step-by-step approach to help you get started:

Step 1 – Select a Suitable Location

Choose a place that is easily accessible to the local population. The spot should have a steady footfall, preferably in a market or central village area.

Step 2 – Arrange Infrastructure

Get all necessary tools in place: computer, scanner, internet, and printer. Ensure your workspace is ready for daily operations.

Step 3 – Register Yourself

Choose a platform that facilitates setting up service centers. Register by submitting your details, uploading documents, and completing the eKYC process.

H3: Step 4 – Get AEPS Activation

Ensure your center is authorized to offer Aeps Service. This enables Aadhaar-based banking transactions like balance inquiry, withdrawals, and fund transfers.

H3: Step 5 – Start Offering Services

Once everything is set up and verified, you can begin offering digital services such as:

- Mobile and DTH recharge

- Utility bill payments

- Money transfer services

- Mini statements and balance checks

- Cash withdrawal using Aeps Service

- PAN services, insurance enrollment, and more

Common Challenges and Tips for Success

Though running a Digital Grahak Seva Kendra is straightforward, here are some challenges and tips to manage them:

Technical Glitches

Use updated systems and maintain proper connectivity to avoid downtime.

Customer Awareness

Educate your customers about digital services and how they benefit from Aeps Service transactions.

Managing Trust

Build trust through transparent processes and by issuing receipts for every transaction.

Regulatory Updates

Stay informed about government regulations, as digital service models may evolve over time.

Growth Opportunities

Once your center becomes operational and gains traction, you can expand services. Some ways to grow include:

- Offering additional government and financial services

- Hiring an assistant for high footfall areas

- Extending service hours for convenience

- Partnering with other small businesses

The model allows flexibility and long-term sustainability if managed efficiently.

Conclusion

Opening a Digital Grahak Seva Kendra is a practical and socially impactful initiative, especially in areas where formal banking and digital services are scarce. With the integration of Aeps Service, these centers enable secure, real-time financial transactions, boosting both convenience and financial inclusion.

If you’re planning to start one, follow the steps shared above carefully – from arranging infrastructure to registering for services. With the right approach, your center can become a valuable resource in your community, while also providing a consistent income.